TSMC relies on billions in debts to fund its operations.

Taiwan Semiconductor Manufacturing (TSM 1.26%) is one of the most important companies in the world. In fact, according to some, it is the most important company.

TSMC, as it is also known, is the world’s largest contract semiconductor manufacturer. It’s the company that many of the world’s biggest chip users like Apple, Nvidia, Broadcomand Advanced Micro Devices rely on to manufacture their chips.

As a result, TSMC is one of the most valuable companies in the world, and like most manufacturers, it has billions of dollars invested in its foundries, or the plants that make those chips. It finished the first quarter with $95.4 billion in property, plant, and equipment, which represents the book value of its factories rather than the market value, which is likely higher.

However, it also funds its growth through debt, and now has $30 billion in debt on its balance sheet. Is this a serious risk for TSMC? Let’s take a closer look at what investors should know.

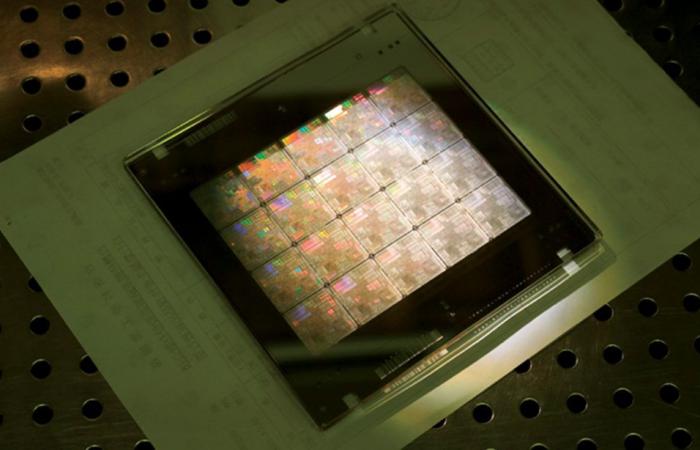

Image source: TSMC.

TSMC’s debt burden

At $30 billion, TSMC’s debt balance seems proportional to the size of its business. The company generated $71.5 billion in revenue in its last four quarters and $30 billion in operating income, showing the company has wide operating margins and pricing power, a result of its competitive advantages and leading industry position in semiconductor manufacturing.

Taking a look at Taiwan Semi’s assets, its balance sheet also looks strong. In fact, the company has $53 billion in cash and equivalents and another $7 billion in short-term investments. It could easily pay off its debt if it needed to, and it collects net interest income instead of paying interest expense like most companies.

So while TSMC competes in a cyclical industry that occasionally crashes, the company can easily afford its $30 billion in debt.

Jeremy Bowman has positions in Broadcom. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.