Hungarian economist Péter Ákos Bod states that since the fall of the communist regime, there have been few certainties in the minds of Hungarians, such as the fact that they are more advanced than Romania. But now even this has been disproved. In terms of GDP per capita, Romania took it ahead of Hungary, and in terms of consumption it is already far ahead of the Hungarians. The Economist conducted an extensive comparative analysis Portfolio.hu, entitled “Who should Hungary catch up to? Forget about Austria, we have enough of Romania!”

- Péter Ákos Bod is a Hungarian politician and economist who was Minister of Industry and Trade in József Antall’s cabinet from 1990 to 1991, then Governor of the Hungarian National Bank.

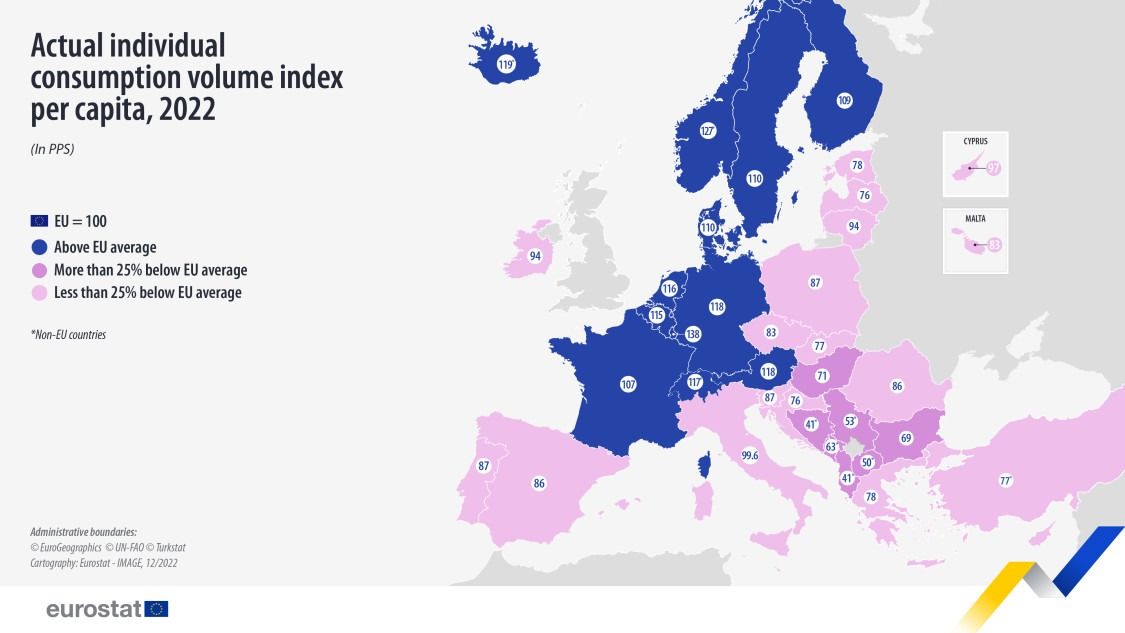

That Romania surpasses Hungary is not surprising, says the economist. According to him, the general public, which is not particularly concerned with the economy, was moved by the news that Romania surpassed Hungary in terms of GDP per capita in 2023. Eurostat measured the member states in relation to the EU average based on preliminary data from last year. Hungary is towards the bottom of the range.

Also, on the usual indicators of economic performance, Hungary is outperformed by most of the older EU member states, but also by the new ones that joined the EU 20 years ago, together with Hungary: the Czech Republic, Slovenia and Estonia. Also, the Polish economy has grown steadily from its previously low level and has caught up with Hungary over time.

But Romania’s case is definitely different, the economist emphasizes. According to him, the affairs of a confusing and rapidly changing world are now seen through awareness of Hungary’s relative development compared to its neighbors to the east and south. In addition, Romania – together with Bulgaria – became a member of the EU even later. The latter country is relatively far away, as are Latvia and Lithuania, and neither is within the Hungarians’ frame of reference – but neither is Romania or the Czech Republic.

The economist claims that those who regularly read the news should not be surprised by the fact that Romania surpasses Hungary, because even last year, according to the data for the year 2022, there was a close competition, even if in Hungary – being an election year – the consumption and household investment received a large tailwind from economic policy. Only then came the recession of 2023: Hungarian GDP decreased by almost 1%, while Romanian GDP increased by more than 2%. So the recession is now also validated by the data.

The economist shows that what Hungarians hear about the conditions in Romania or what they see in the Szeklerland does not match the GDP data. In such cases, people tend to question the numbers.

However, the consumption level of Romanian households exceeds that of the Czech Republic and is roughly at the same level as that of Slovenia in a given year, he says.

He also shows that capital and technology have also reached economies that were more closed during the communist regime and more dependent on the domestic market to develop. If we take the contribution of foreign-owned enterprises to the country’s GDP as a significant indicator of the structure of the economy, indeed, Hungary is still the leader in the region, with 50%, and Slovakia is second, with 48%. But the other countries in order are Romania (44%), Czech Republic (43%), Estonia (40%) and Poland (37%). So, in the meantime, there has been rapid internationalization and imports of capital plus technology in the Romanian economy (and in Poland, with its 40 million inhabitants and a large domestic market).

Romania’s economy, the economist also says, is more diversified and businesses are not as dependent on one or two sectors as in the case of Hungary or Slovakia. The automotive industry is also important in Romania, but its share is smaller, while business service companies are very important in terms of employment.

From the point of view of the slowdown and stagnation of Hungarian regional development, the significant economic weight of the big cities outside the capital is particularly notable: Cluj-Napoca, Timișoara, Iași, Constanța, Oradea are business centers with strong dynamics. These cities, sufficiently distant from the capital and big politics, enjoy much greater autonomy from a local point of view, while being part of a large market, where competition is fierce by Hungarian standards.

The size of the country is a given. But the role and weight of the state is the product of a historical process. The Romanian state centralizes approximately 33% of GDP; Hungary’s has a 10 percentage point higher revenue share and similarly overdeveloped public spending, with all its efficiency and corruption risks. The microeconomic intervention of the Hungarian state has become much more extensive in the last decade than in any other EU member state, new or old.

The economist claims that Romania’s development is an interesting matter in itself, but for Hungarians the main question is why, in the 20 years of EU membership, not only has Hungary lagged behind the hoped-for development, but also – and the numbers are quite clear – behind many of their Eastern European peers with deeper roots. The examples of Romania, Poland, the Baltic States and Slovakia provide a contrast that makes the analyst ask questions.

| Real GDP growth in emerging and developing European countries | |||

| 2023 | 2024 | 2025 | |

| Bulgaria | 1.8 | 2.7 | 2.9 |

| Hungary | -0.9 | 2.2 | 3.3 |

| Poland | 0.2 | 3.1 | 3.5 |

| Romania | 2.1 | 2.8 | 3.6 |